How to Build Credit in College

“Remember that credit is money” — Benjamin Franklin

Building good credit in college is one of the best financial moves a student can make. Having good credit allows students to qualify for personal loans, business loans, rental applications, auto insurance, and can help them get a job. Yes, some employers can look at credit reports when deciding whether to hire an applicant. Also, building credit while in school means that students won’t be starting from scratch when they graduate.

Why Building Credit Matters

Credit score in America is actually very important no matter what your age. A common misconception is that students don’t need to build credit because they only need good credit for things like financing a new home. If you’re a student however, credit can impact you right now. In fact, it’s determining your interest rate for student loans and if you’re thinking about consolidating your loans after graduation, a good credit report could land you a better interest rate.

Besides those immediate needs for good credit, building a solid credit history early can have a huge effect on an individual’s future financing abilities. According to FICO, 15% of a credit score is based on the length of the credit history. The earlier a student can begin building their credit, the better off they’ll be and some of the following benefits can be expected:

Significant Savings from Lower Interest Rates. For financing big-ticket items like rent or a new car payment, even a slightly lower interest rate can turn into thousands of dollars of savings. Those with the highest credit scores are generally able to secure the lower interest loans and that can mean lots of savings over time. Savings can also apply to insurance costs as higher credit usually translates to lower premiums.

Better Loan Terms and More Options. Students with strong credit scores have access to the most loan and credit card options. Those with high credit scores have the option to compare terms and choose the best terms, like higher spending limits, which help when financing big purchases.

Work up to the Best Credit Cards. The most rewarding credit cards on the market can be extremely valuable for students. The best cards can offer rewards like cashback offers, travel points, gifts, and other incentives. A travel rewards credit card is usually very appealing to students, since they can book entire Spring Break trips with accumulated travel points alone!

More Housing Options. Some landlords look at potential tenants’ credit scores to determine whether or not they are able to pay rent. The higher the credit scores, the more likely a renter is to be approved for a home or apartment rental.

How to Build Credit

1. Choose a Card That’s Right for You

Getting a first credit card can be difficult, but there are a couple of good options to start out.

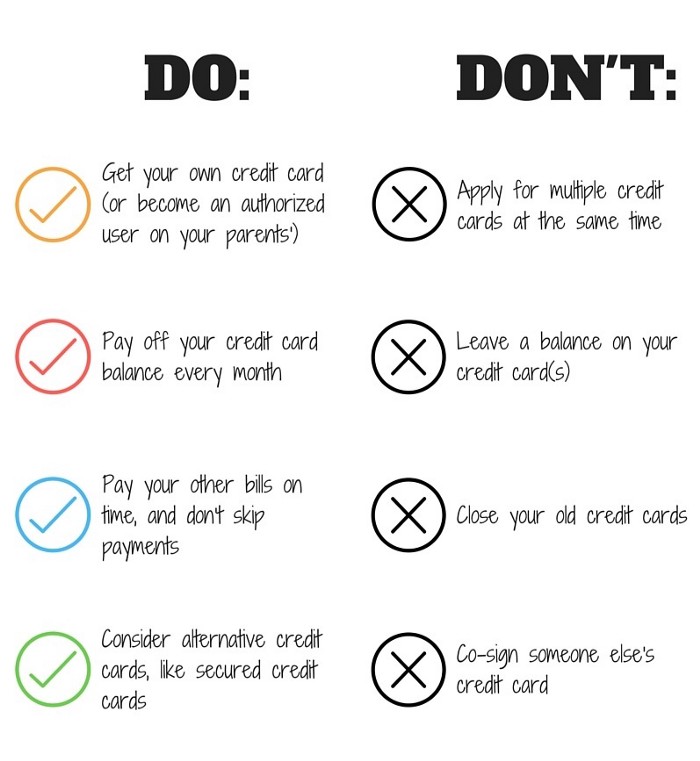

Start with a secured card or a student credit card. A secured card is basically just as a debit card that builds credit. It doesn’t actually give you a line of credit, you have to “secure” the card by depositing money like a debit card. However, unlike a debit card, every month it gets reported to the credit bureaus.

Get a co-signer. Banks and lenders generally consider it risky to hand a credit card to a college student with no credit history. For students struggling to get a first credit card, getting a parent to co-sign might be the best option.

Once a student has gotten their first basic credit card, they can start thinking about cards with better rewards. NerdWallet and WalletHub are two great sites for finding and comparing different credit cards.

2. Learn to Use a Credit Card

Simply having a credit card doesn’t help you build credit — you have to actually use it! If you use your card responsibly, you can start building a great credit score over time.

Understand how credit card interest works.

Have perfect payment history. This has the greatest influence on your credit score. It’s important then to have perfect payment history! Don’t miss payments!

Don’t max out your credit limit. Lenders like to see that you don’t have a habit of maxing out your available credit. Aim to keep your credit card balance to 30 percent of the credit limit or less — so for a card with a $1,000 limit, try not to exceed spending $300 before paying it off.

The longer your credit history, the better. A long credit history shows how you’ve managed credit over time, and it can positively affect a score. If you’ve just started using credit, your account history will be brief. Focus on the variables you can control, such as making on-time payments, and your credit history can naturally improve over time.

Don’t open and close accounts frequently. Closing an account may shorten your credit history and reduce your available credit, both of which can lower your score.

Don’t let a new card sit in your wallet. Use it or the bank may close it due to inactivity. Put small, recurring charges on it, such as a Netflix account or other website subscriptions you regularly use. Don’t make any big purchases unless it’s an emergency.

Once a student has had their first card for a year or so and it has perfect payment history, they should be on the lookout for a major credit card with better benefits.

3. Build Good Financial Habits in College

We’ve explored this topic more deeply in another article, but the basics here are simple: Create a budget, set up an emergency savings account, and make sure you have a source of income (even if it’s from your parents).

Setting up a budget by using a tool like Mint can be very helpful. The U.S. Department of Education also has advice on how students can create a budget. Just be aware that sticking with your college budget is just as important as making one and that learning to manage your money is an extremely useful lifelong skill.

Reaching a credit rating around 700 is an appropriate goal for college students who start early.

Build Credit in College!

In a 2016 study from Student Monitor, students with a credit card in their own name reported having a mean credit score of 679. In contrast, students who didn’t have one had a score of 629.

College students aren’t particularly well regarded for their credit history. The average credit score for 18 to 24 years-olds is pretty bad, at just 630 according to CreditKarma. Generally, a score below 650 is considered bad, a good credit score is 700 or higher, and an excellent score is above 800. If a student has successfully built credit over their time in college, they can expect a score around 700, which is a great start for a young adult.

Being responsible with a credit card is the best way to establish and improve a credit score. For college students with no or little credit history, there are small but important steps they can take to show their creditworthiness. The benefits from building a strong credit score early can be immense, and we highly recommend college students to consider building credit ASAP.