Reviewing and Responding to your College Offers

After years of planning and preparation, you finally checked off all the boxes on your list and completed all of your college applications. Now the time has come for colleges to start sending offer letters, and you’re likely spending your free time refreshing your inbox hoping for good news. However, perhaps the thought has crossed your mind: what happens when the good news comes?

Of course, step number one is to give yourself a well-earned pat on the back. This is certainly a cause for celebration, as you and your family have worked hard for this moment. Take a moment to reflect on how far you’ve come. You’ve just been offered the opportunity to make one of the most important investments in your life — a true investment in yourself and your own higher education. If you haven’t yet already, I highly advise taking some time to learn just how important college is to the average American. This is a big deal!

Examining your Offer

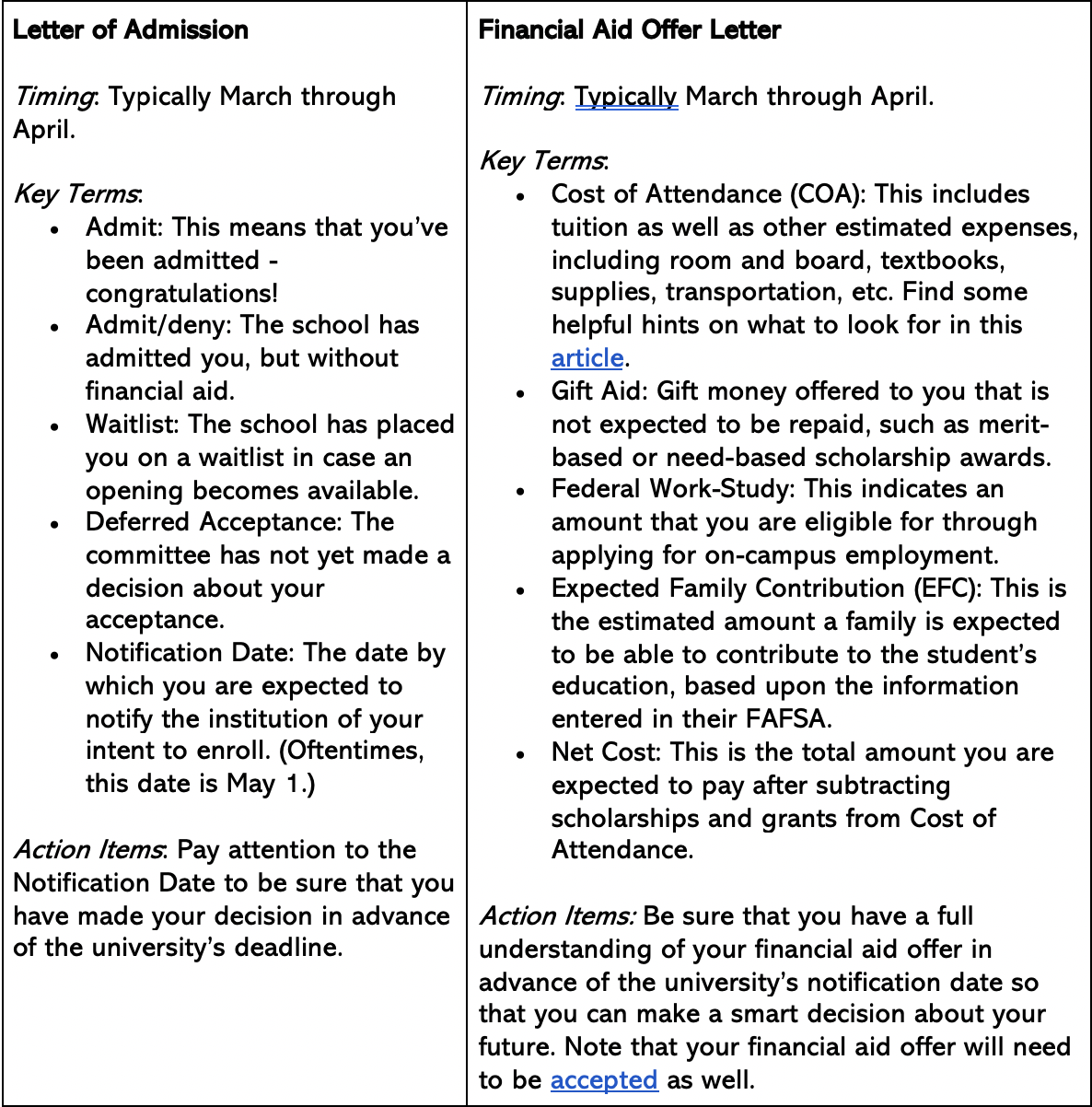

Now, Let’s break down the offers that you’ve received by first taking a look at some of the key elements of your letter of admission and your financial aid offer letter, the two most important documents in any college admissions offer.

Letter of Admission

When reading through your standard admissions letter, the most important part is the dreaded few words of “we regret to inform you” or “we congratulate you”. Unfortunately, most admissions decisions are final and cannot be changed. If you’ve applied to multiple schools, make sure you’re keeping track of all of your letters and all the deadlines that apply to each offer.

As soon as you receive all of your letters of admissions, you should:

- Reach out to your college counselor to discuss your offers. If they’ve assisted you with your application process, they’ll be eager to know the end result, and will be happy to help discuss how the offers relate to your goals.

- Set a reminder for yourself of any deadlines noted in the letter, and exactly what is due on those dates. Is a deposit required? Will you need to commit to housing? How do you express your intent to enroll?

- Stay focused in school. We know you may be hearing about “senioritis” — but it is not an excuse to slack off. Colleges expect you to finish your senior year with the same good grades you started with.

- If you were waitlisted or deferred, keep in touch with the school to find out if there is anything you can do to supplement your application.

- If you did not get into the college you wanted, talk to your counselor about options for transferring after a semester/year or deferring for a similar time.

Financial Aid Offer Letter

Your award letter will come around the same time as acceptance letters from your schools. If you apply to multiple schools and list them on your FAFSA, then you’ll receive a financial aid award letter from each accepted school. An award letter will include the school’s cost of attendance for one year and how much your financial aid package will cover. This should give you and your family a clear idea of whether you can afford to attend and how much money you’ll need.

Once you receive your award letter, you can use Finaid’s award letter comparison tool or SallieMae’s free financial aid comparison worksheet to compare and contrast your offers. Once you have that information, you can contact one of the university’s financial aid officers (FAOs) with any further questions you might have.

The most important information to know is what kind of aid you’ve just been awarded. It usually comes in three forms:

- Free money is money that you don’t have to pay back: scholarships, grants, and fellowships.

- Borrowed money is money you’ll need to pay back with interest: federal student loans (which may be listed as “Federal Direct Loans”) or credit-based loans (like Direct PLUS Loans, which come from the federal government, or private student loans).

- Earned money comes in the form of work-study, which is essentially a part-time job offered by the university with earnings going towards tuition.

When considering the cost of attendance, remember that there are many other costs not outlined in your financial aid award letter. There are many costs to consider that go beyond tuition like, books, travel, clubs, off-campus housing, and dining.

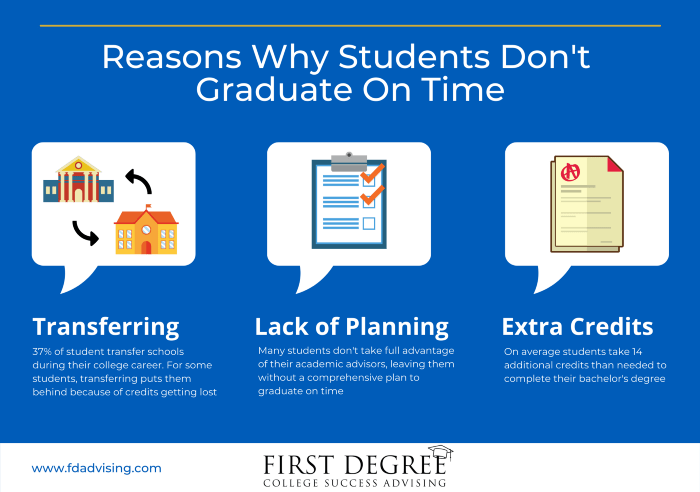

Another essential cost to consider is the likelihood of overspending. It’s well known that 4-year graduation rates in most colleges around the nation are disturbingly low. Whether intentionally maliceful or not, most universities use a standard of less-than-or-equal-to 6 years to define “on-time” graduation and thus disguise their 4-year graduation rate. Take some time to specifically look for the 4-year graduation rate of each school you’ve been accepted to.

To take a quick example of the seriousness of overspending, UCLA has a reported 91.8% graduation rate, but a 75% 4-year graduation rate. That means for UCLA students, there’s a 1 in 4 chance they will take more than four years to graduate — usually adding tens of thousands of dollars in unexpected overspending.

For a more realistic college cost estimate and to better prepare for unexpected costs, the typical rule of thumb is to add on at least another 10% of your original cost of attendance.

If you don’t receive enough financial aid to cover your college costs, there are several ways to lower costs. One easy way is applying for scholarships. There are many benefits of applying for scholarships year-round, so keep searching and applying to scholarships even during the spring. Although private scholarships are typically not as helpful as institutional scholarships, every little bit helps.

Many students need additional money beyond federal grants, scholarships, and loans. You may consider cost-cutting tactics like living at home, taking summer classes, or taking transfer-eligible course equivalencies, a tactic we specialize in at First Degree, which can reduce college expenses by as much as 30%.

If you really need to, you can take out a private student loan. College Ave Student Loans is a well known site for finding private student loans that match your needs.

Negotiating your financial aid offer is one of the best ways to cut costs early and often a very worthwhile endeavor. Colleges plan for students and families to negotiate their letters and have some kind of budget to respond accordingly. Unfortunately, most families don’t negotiate at all, and end up leaving thousands of dollars on the table.

Since this is mostly a financial discussion, it’s recommended that the parents take charge here and write a well thought out letter. The goal in this letter is to show that your current income, assets, and savings cannot cover the cost of attending college. Remember that FAO’s are just people looking at a snapshot of your finances. They only see the numbers — they don’t see the story behind those numbers. If anything has changed about your financial situation, if anything will change, or if there’s anything you can mention to shine a better light on your situation, you should relay any and all of that information to your FAO in a polite, professional, friendly manner.

How To Negotiate

- Know your number — How much more do you need?

- Don’t send in your deposit too soon.

- Bring proof of your additional need.

- Use award letters from other schools as a negotiation tool.

- Request the right kind of aid — need vs merit.

- Be courteous and professional.

Comparing Multiple Offers

If your child has received multiple offers with sufficient financial aid, and not exactly sure which one to enroll in, it might help to revisit the questions, worksheets, and resources noted in our How to Get Into College: Exploring and Selecting Your Target Colleges article. Even then though, making the ultimate decision can be challenging, especially when it comes between two very likeable schools. If you’re still trying to decide between different schools, we recommend the following:

Ask questions. Create a list of as many questions as possible about the colleges you’re considering. You may want to get answers to questions like these:

- How many students return after freshman year? How many graduate?

- Does the college offer a lot of majors I’m interested in?

- What can I do for fun? What’s unique about the culture?

- What are the professors like? Are there any classes I must take?

- Do graduates go on to fulfilling and well-paying careers?

Get answers. The best place to get an answer depends on the question. Here are some of the resources that can provide information:

- People who work at the college — advisors, professors, teaching assistants.

- Current students at the college

- The college’s official website and its College Search profile

- Alumni (LinkedIn is a good tool for this)

Visit — or revisit — the campuses. If possible, check out a college’s campus to get more information. If you can’t visit a campus, call or email the admission office with your questions. Ask if someone there can put you in touch with current students and recent graduates. Your high school counselor and teachers also may know students who graduated from your high school and now attend the college. An interesting tool for virtual college visits is InDuck.

Think things over. You’ve done research and asked questions. Now it’s time to check in with your own thoughts and feelings and have your child ask themselves questions like these:

- How did I feel when I was on campus at each college I visited?

- Which colleges best match my list of must-haves?

- At which colleges can I imagine myself as successful and happy?

Compare the colleges. Together, use your new information to sort the colleges by what they offer and what you want. Make a list of the pros and cons for each college. You can also use College Search to compare up to three colleges side by side.

- Finances: Can you and your family realistically afford this school? Are there financial aid options available to you if you attend this school?

- Location: Do you really want to live in ________ for the next four years?

- Campus: Do you get a good impression of the campus when you visit it? Do the buildings and the overall campus make you excited to go there?

- Friendships: Are you going to know anyone or have anyone to help you get settled if you go to this college? Are there groups and clubs that you can fit into nicely?

- CareeProspects: Is this the best college to gain the skills that will help you pursue the career field you are interested in? Is the degree program that you would be entering into well-ranked?

- Distance from Home: How often would you be able to travel back home and see your family/friends while you were in college? Is that amount of time enough for you?

Carefully consider alternatives: Calmly talk with your child about possible alternatives, even if he or she is obsessed with attending a particular college. Point out the short-term and the long-term drawbacks of taking too big of a debt load and start building healthy budgeting habits. Explore whether attending a community college for a term or two, taking summer classes, or starting out as a part-time student to build up residency. In good housing markets, well-off families might consider purchasing an appreciating home/apartment for their child to live in to avoid rent. There are lots of ways to cut costs in college, and when the grand total comes out to tens or even hundreds of thousands of dollars, every little bit counts.

Checking Deadlines, Making the Decision, and Responding to Colleges

This can be a tough decision, but you don’t have to decide overnight. Usually, colleges don’t expect your final decision until May 1st, in 2021 this date has likely been extended for most colleges. Keep in mind too that colleges are serious about reply deadlines. If you don’t send your deposit in time, you risk losing your place.

Once you’ve decided which college you want to attend, inform all the colleges that accepted you about your decision.

Respond to the college you’ve decided to attend. Make sure to send in the following items by the deadline:

- Your acceptance letter

- A deposit

- A separate acceptance letter for financial aid, if required

- Any other required items

You can use a College Application Worksheet like this one to keep track of your applications.

Respond to the colleges whose offers you’re declining. Send a brief note to the other colleges to thank them and turn down their offers. This frees up places for other students.

When accepting an offer, the college usually requires you to submit a financial deposit to formally start the enrollment process. The due date of the deposit may vary and be different from the due date of the acceptance confirmation. But regardless, we highly recommend you to take care of the deposit as soon as possible and send it in along with acceptance confirmation.

B are also a couple of caveats to keep in mind. (1) Try to remember that there is no such thing as a perfect school. College is what you make it, so if you put in the effort, you’re sure to have a great experience at whichever school you decide. (2) If you truly find there is a better school out there for you, you can always transfer. However, if you do go consider that option, be sure you carefully plan your credit transfer eligibility, as losing course credits can be a costly expense.

That being said, whatever your final choice may be, you will have to make it soon! Be sure you’re putting an appropriate amount of thought into it now and avoid later regrets.

Start Preparing For Your First Semester of College

You have gone through the wringer with college applications, but unfortunately, your work isn’t over just yet! For now, you have the task of researching and picking your favorite college. Later though, you’ll be attending orientation and preparing for your first days on campus. Exciting stuff! But with that comes many logistical complications that you’ll need to work out well before Day One of college. Here is a shortlist of some of the things you need to start thinking about sooner rather than later so that you’ll be ready for college:

- Attending your college orientation

- Submitting all vaccinations and other necessary forms required by the university

- Researching and signing up for your fall-semester classes

- Creating a rough draft of your four-year degree plan (you’ll want to bring this to orientation)

- Finding Housing/Roommates

- Buying everything you need to furnish your housing and prepare for class

If you’re having any issues making these tough decisions, feel free to reach out to us for one-on-one guidance. We’ll help you talk through your offers, ensure you’re making the most of your financial aid offers, and help you compare your choices. Throughout this spring and summer, we’ll continue putting out more advice and guidance so you can feel confident that you’ll have a successful freshman year. Stay tuned and subscribe to our newsletter for our newsletters and extra resources!!